Drive revenue in any market

What is Sales Boomerang?

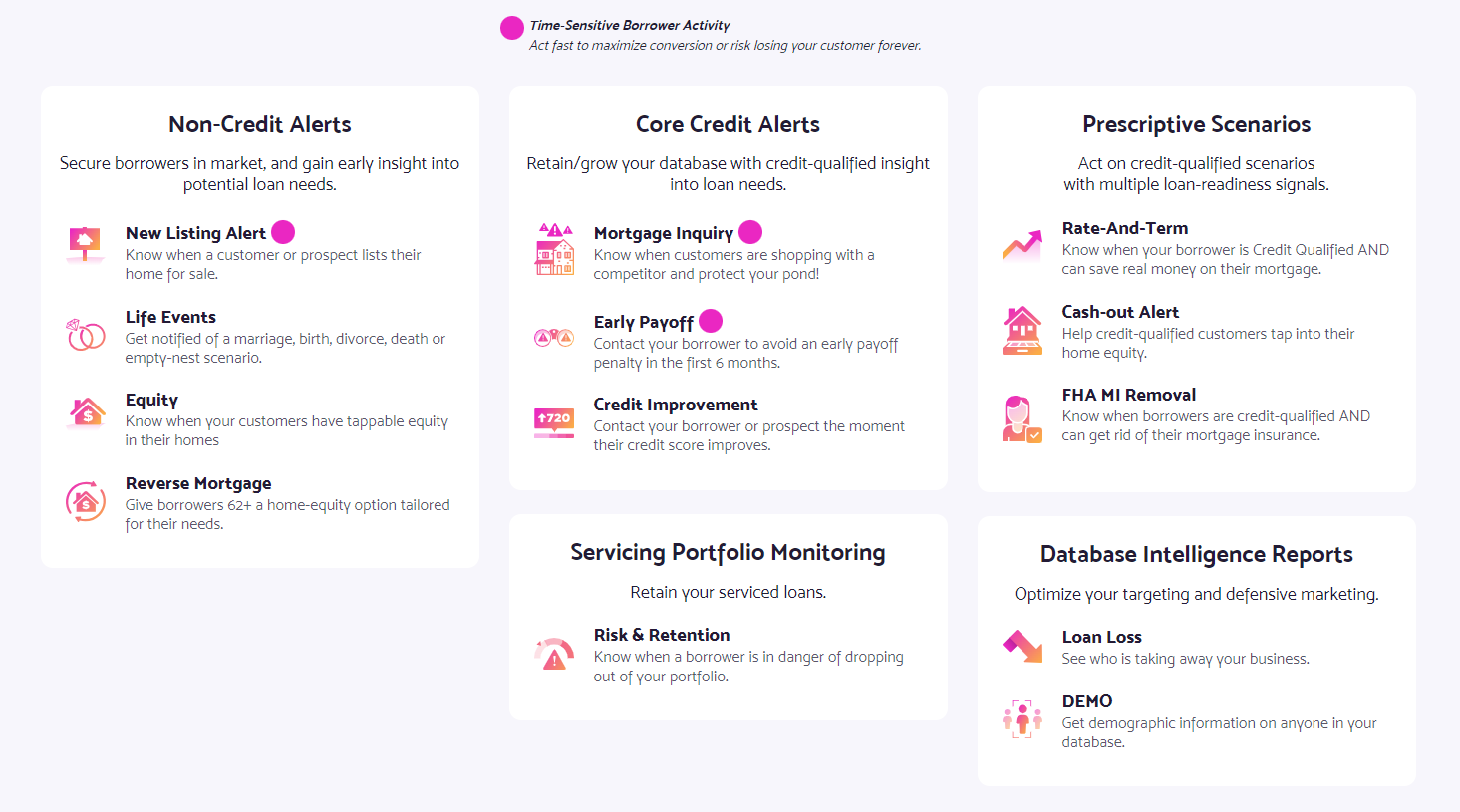

Sales Boomerang is a borrower intelligence and retention platform explicitly designed for the mortgage industry. It uses advanced data analytics and monitoring to provide real-time alerts and insights about borrower behavior and market conditions. These real-time alerts notify lenders of borrower activities such as credit score improvements, rate drops, equity increases, and other significant life events that may indicate readiness for a new loan. By analyzing borrower data, Sales Boomerang provides actionable insights that help lenders identify and engage with potential borrowers at the optimal time.

The platform’s capabilities extend to aiding lenders in maintaining continuous engagement with their borrower base. This is achieved through automated and personalized outreach based on borrower behavior and market triggers, which increases the likelihood of repeat business and referrals. Sales Boomerang ensures that lenders stay connected with past, current, and prospective borrowers, allowing them to capitalize on loan opportunities as they arise. Its comprehensive approach helps identify immediate loan prospects and build long-term relationships by keeping borrowers informed and engaged throughout their financial journey.

Why we use Sales Boomerang

Success Mortgage Partners (SMP) leverages Sales Boomerang to enhance borrower retention and engagement by utilizing real-time data and actionable insights. By receiving alerts on borrower activities such as credit improvements or rate drops, SMP can proactively reach out with tailored financial solutions, increasing conversion rates and customer satisfaction. The seamless integration with SMP’s CRM system ensures efficient data management and timely communication, helping SMP stay ahead of borrower needs and market trends. This strategic use of borrower intelligence not only drives business growth but also strengthens client relationships and loyalty.

Sales Boomerang and Trust Engine work together to provide lenders with comprehensive borrower intelligence and engagement solutions. Sales Boomerang alerts lenders to borrower activities and opportunities, such as credit improvements or rate drops, using real-time data. Trust Engine enhances this by offering deeper analytics and insights into borrower behavior, helping lenders build trust and tailor their communication strategies. Together, they enable lenders to anticipate borrower needs, deliver personalized outreach, and strengthen client relationships, ultimately driving business growth and retention.