GUIDING YOU THROUGH

Success Mortgage

Partners, Inc.

Everything you need to know about our

organization and what it truly means to be part of SMP

Quick Navigation:

Core Values

Family First Financing

We provide a welcoming, enterprising, family-oriented work environment that supports and celebrates you. We believe in your potential, and we’re here to help you achieve your goals.

Benefits of SMP

SMP believes in increased compensation for increased contribution. Our mission is to earn positive national recognition by consistently providing our branch offices with quality support. By hiring and training excellent operational personnel, we enhance branch office efficiency and growth.

Working for You

SMP provides an engaging work environment with opportunities for community outreach, fun, and education. Offering a wide variety of industry seminars to attend, Dale Carnegie self-improvement courses, and a unique library of employee-curated resources, we work to ensure you have everything you need to succeed.

Mastermind Training And Business Development

Loan officers of Success Mortgage Partners, Inc. have a host of tools to help them succeed—proving that success is not just what we do; it is what we do for you.

Social Media

Team building

Marketing to your database

Interviews and tips from top producers

Leadership training

Foundation and mindset

Grow your business strategically & improve customer retention

When you join SMP, you gain access to Success Unlimited, an interactive online platform where you can find exclusive marketing and sales resources, expert advice, and industry insights.

“Run your day. Don’t let the day run you. Success Unlimited will teach you how to master your day and reap the rewards of this mastery.”

KEVIN BROUGHTON

Legacy of Leaders

At Success Mortgage Partners, Inc., we are more than just partners—we are a family of trusted mortgage professionals. With integrity as our guiding principle, we take pride in creating lifelong relationships by dedicating ourselves to your client’s mortgage needs. Whether they are consolidating debt, refinancing their home, or buying their first house, we have the expertise to make it a fast, easy, and enjoyable process. Our top professionals bring exceptional and vast mortgage knowledge for a trusted and safe lending experience.

VINCE LEE

Co-Owner & Co-Founder

Owen Lee

Co-Owner & Corporate Counsel

2025 MBA Vice Chair

Kevin Broughton

Co-Owner & Chief Recruiting & Retention Officer

Allison Johnston

President

Success Mortgage Partners, Inc.

Lends Across The Nation

A strong organizational foundation is built upon the shoulders of those who came before us. At Success Mortgage Partners, Inc., that foundation sets the footholds of families across the nation. Let us show you how our business of financing truly starts and ends with family.

Success Mortgage Partners, Inc. currently lends in 44 states and territories.

Information as of January 2025.

Our Compensation Models

One of the best aspects of joining SMP is that you play a major role in determining your compensation plan. Both Branch Managers and Loan Officers have the ability to choose from a variety of compliant pay structures.

On the Loan Officer side, we offer draw plus commission plans. For Branch Managers, we offer two different options—including a “true” P & L model, where the Branch Manager earns a monthly profit if the branch operation is profitable, and a hybrid model, where the branch is structured as a corporate branch and the BM receives a fixed override on total branch closed-loan production.

Our primary goal is to assist sales professionals in selecting the plan that will best suit their business strategy. Making sure the proper plan is in place is key to maximizing the amount of money available to our loan originators. Plan selections are reviewed quarterly to ensure they are still the best fit for each team member.

We truly appreciate your willingness to explore SMP. We hope to provide insight into the most important question, “Are we stronger together?” If so, we look forward to many happy and productive years together as partners.

Welcome Aboard!

Loan Program Training

MARKETING TRAINING

COMPLIANCE TRAINING

BUSINESS-GRADE

TECHNOLOGY SETUP

I.T. WALKTHROUGHS

& LIVE SUPPORT

EFFORTLESS BENEFITS

ENROLLMENT

SUBJECT AREA EXPERTS

SUPPORT HOTLINE

AFTER HOURS SUPPORT

“I enjoy helping out any team member with their questions. I’m always seeking that lightbulb moment when the team member understands the learning topic and can apply it to their work every day.”

Operations

Overview

Working Behind the scenes

We invest in our team and nurture a positive culture where the goal is to exceed the expectations of not only our customers— but of each other. Our staff is highly trained, motivated, and always willing to go the extra mile to get things done for you.

Quick Turn Times

We offer a cutting-edge, automated, underwriting experience including Encompass integrations and efficiencies alongside an accelerated closing process. Most loans are underwritten in-house, allowing you direct access to underwriting. The underwriter will call on every approval, allowing you to discuss the file and outstanding conditions.

Sales-Centric Environment

As we continue to grow, we are continuously transforming and adapting to change, but we will always remain a sales-focused organization. Our loan officers and their clients together are the backbone of our success: without an exceptional sales staff, we would not be where we are today. Our goal is simple: to offer the best support possible to our sales family with the best service available in our industry. We are here to offer you all the support you need to help make this high-involvement purchasing decision for your client a memorable and happy experience.

EXPRESS FUNDING

Express Funding means no need to wait on funding document approval the day of closing!

Referral-Based Support

Our Underwriting Scenario Desk guides you through unique loan scenarios, while our advanced marketing and technology resources—such as Total Expert, Success Express (Blend), and Microsoft Power BI—make building your business, co-marketing with realtors, and closing loans quick and easy. You’ll also have direct access to corporate marketing associates to help you with successful solutions for modern lending.

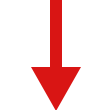

Lending Made Easy With Blend

A Successful Solution to Modern Lending

Get clients into their homes faster and easier! Help improve your client’s home-buying experience! Loans started in Blend can close up to nine days faster than those not originated through the Blend platform.

WHAT IS BLEND?

Blend is an intuitive, customer-friendly, digital loan application that can be finished anywhere, anytime.

AUTOMATION

Seamless connection for customers to their asset accounts. After a consumer has connected their account, Blend verification automatically imports asset data and creates the asset statements.

EFFICIENCIES

Blend utilizes intelligent conditioning to automatically request documents based on the answers given during the loan application.

DOCUSIGN

The loan team can leverage the DocuSign integration to create and send eSign documents to the borrower to simplify the gathering of supporting information.

Compliance

Keeping You Covered

There are two departments within compliance: the Disclosure Desk and the Compliance Department, both exist to support your sales team. Our goal is to protect the company and our loan officers—while finding the “yes,” whenever possible.

Processing

Keeping Your Loans Moving

The Solution-Oriented Processing Department at Success Mortgage Partners, Inc. provides the greatest customer satisfaction to our loan officers and loan partners by making their needs our number one priority. Corporate Processing will communicate to our loan officers and loan partners effectively, positively, and with the highest sense of urgency. We strive to provide the most outstanding customer satisfaction in the industry by ensuring every transaction is processed accurately and efficiently.

Underwriting

Making the decisions that make sense for you

Communication

Communication

Our focus is maintaining an open line of communication between the Sales Team and the Underwriting Department. We are always looking for a way to say “yes” to a file, and to do that, it is vital to communicate with the sales team via phone rather than by email.

Structure

Structure

Our Underwriting Department comprises senior and junior underwriters divided into five teams. Each team has a leader who helps with questions from the underwriters and the sales staff, as well as queue management throughout the day.

Turn Time

Turn Time

Our goal is to maintain a 48-72 hour turn time for all new files and conditions. At the end of the month, we tend to focus on conditions to ensure that we are getting every borrower to the table for their scheduled closing so you can close more loans and borrowers can enjoy their new homes.

Escalations

Escalations

If you have a question on a file or need to be granted an exception, you can discuss it with your team lead. To resolve all issues with urgency, underwriting management meets to review all questions, escalations, and requested exceptions every day.

Closing

INITIAL CLOSING DISCLOSER PROCESS

The initial Closing Disclosure (CD) is sent to the borrower prior to receiving the “Clear to Close.” We do a full review of the loan initially and send the CD to the title company or attorney to collaborate. This ensures we have a more accurate bottom line on the initial CD for the borrower. We accommodate all rush requests. We offer e-delivery of the CD to borrowers, as well as shipping via U.S. mail if needed. Wet signatures are, of course, also acceptable. Once our initial review is complete and we have sent the CD to the borrower, we let you know of any items we noticed that need to be corrected, so that you have enough time before you’re clear to close.

FINAL CLOSING PROCESS

Once you receive your “Clear to Close,” we aim to have the final package to title within 4 hours of the loan being submitted to Closing. We do a quick final review of a few items and send an updated CD to title to be sure there are no additional changes needed. Once balanced with title, we wait for your approval before sending the final package to title. We can accommodate rushes for final documents.

FUNDING

We offer express funding for almost all of our loans. This means the title is not required to send any documents to get funding approval—so your clients won’t have to wait around for funds. The wire is always sent before the closing. We overfund our loans to ensure that additional funds will be readily available if there are any last-minute changes.

Jacqueline Sobczyk Esq.

VP of Closing

(734) 864-4119 | Ext. 4119

jsobczyk@smprate.com

ANGELA OSBORNE

Closing Manager

Office: (734) 887-6218

aosborne@smprate.com

Post-Closing

WORKING DAILY TO HIT EVERY PERSONAL AND DEPARTMENTAL GOAL

In the post-closing department, we aim to get the loans purchased by the investors as soon as possible. We are continually looking at new processes and procedures to get the loans scanned, uploaded, reviewed, insured, and purchased by the investors as quickly as possible. Our department completes multiple functions once the loan is closed and closely follows each file to the finish line.

If you need anything, please do not hesitate to contact us directly. We are always here to assist you in any way possible.

We are looking forward to working with you!

Accounting & Funding

The Accounting and Funding Department at Success Mortgage Partners, Inc. has 246 years of collective accounting and funding experience, with 54 of those years serving our team members at Success Mortgage Partners, Inc. Our department is filled with seasoned professionals with different educational and professional backgrounds. We serve our team members in-house and in the field by assisting them with payroll, accounts payable, accounts receivable, and funding-related questions and requests. We also produce monthly, quarterly, and yearly financial reports for our branch managers, executive team, and various agencies to meet all reporting requirements.

Credit Risk

Credit Risk closely monitors and provides updates to industry changes, credit policy updates, and underwriting procedures allowing us to give you a competitive edge. We offer a vast array of programs and products. With three teams ready and able to assist, you can focus on what you do best and leave the rest to us. We are committed to your success—and make every effort to make your loans work.

SMP SCENARIO DESK

The Scenario Desk is a tool that will offer you direct access to underwriting guidelines, investor overlays, and agency guidelines allowing you to focus on your production. The Scenario Desk is accessible for income analysis, interpretation of Agency guidelines, review of unique income and credit history, and much more.

PRODUCT DEVELOPMENT

Product Development is responsible for new product development, product maintenance, and guideline management. In order to better implement procedures and ensure we remain competitive and compliant within this ever-changing industry, we are continuously improving SMP’s credit policy and underwriting procedures while proactively identifying and tracking industry changes.

SMP APPRAISAL DESK

The Appraisal Desk helps remove the middleman by working directly with the appraiser on your behalf while having the option to create your own appraisal panel if needed. We are your voice and advocate and provide only the best client service possible. You are our top priority, and we strive to exceed your expectations every day!

LAURA MONDOUX

Product Development Manager

Office: (734) 927-9671

lmondoux@smprate.com

A Look At Our Current Products

FHA

Standard FHA Programs – 203(b)

FHA 203K Rehabilitation Mortgages

HUD Real Estate Owned (REO) properties

FHA Refinance transactions, including Streamline Refinance, Simple Refinance, Rate & Term Refinance and Cash-out Refinance

FHA Manual Underwriting

USDA

USDA Guaranteed Loan Program

USDA Refinance transactions including Streamline Refinance, Streamline Assist Refinance and Rate & Term Refinance

USDA Manual Underwriting

VA

Standard VA Programs

VA Refinance transactions including Interest Rate Reduction Refinance (IRRRL) and Cash-out Refinance

VA Manual Underwriting

Conventional (Fannie/Freddie)

Standard Conventional programs

Agency High Balance Loan Limits

Agency Refinance transactions

Fannie Mae 97%

Fannie Mae HomeReady

Fannie Mae HomeStyle Renovation

Freddie Mac HomeOne

Freddie Mac Home Possible

SPECIALTY PROGRAMS

What we offer

Jumbo Loans

Down Payment Assistance (DPA) programs

Manufactured Home Financing

Non-QM / Alternative Lending Programs

Construction Financing

TBD Property –

Full Credit / Income Underwrite

Reverse Mortgage

HELOCs

Temporary Interest Rate Buydowns

Success Mortgage Partners, Inc. supports Equal Housing Opportunity. NMLS ID# 130562. (www.nmlsconsumeraccess.org) This is informational only and is not an offer of credit or commitment to lend. Interest rates, products, and loan terms are subject to change without notice and may not be available at the time of loan application or loan lock-in. Contact Success Mortgage Partners, Inc. to learn more about your eligibility for its mortgage products. Loans are subject to buyer and property qualification. Cash reserves may be required. Success Mortgage Partners, Inc. is not acting on behalf of or at the direction of HUD/FHA or the Federal Government.

Conventional Loans

Standard Conventional programs

Agency High Balance Loan Limits

Fannie Mae HomeReady

Freddie Mac Home Possible

VA Loans

SERVING THE MILITARY COMMUNITY WITH PRIDE

features

- Standard VA Programs

- VA Refinance transactions including Interest Rate Reduction Refinance (IRRRL) and Cash-out Refinance

- VA Manual Underwriting

“The veteran community is of great importance to Success Mortgage Partners as our founder, Vincent Lee, is a veteran. We have a unique understanding of this incredible loan program—which has allowed us to house many borrowers who were denied by other lenders. We are not intimidated by high ratio or high balance VA loans and will do concurrent closings if the purchase of a property depends on the sale of an existing VA loan. We prioritize serving those who have served us.”

MIKE FISCHER

Director of VA Lending

Mobile: (734) 395-7797

mfischer@smprate.com

FHA Loans

The FHA loan is one of the most popular mortgage options for first-time homebuyers —with low down payment options, less stringent credit standards, and a variety of loan types to fit any budget.

- Standard FHA Programs – 203(b)

- FHA 203K Rehabilitation Mortgages

- HUD Real Estate Owned (REO) properties

- FHA Refinance transactions, including Streamline Refinance, Simple Refinance, Rate & Term Refinance and Cash-out Refinance

- FHA Manual Underwriting

USDA Loans

USDA-backed loans offer eligible rural borrowers the opportunity to own their own home with no money down. Multiple housing options are available, all within USDA-eligible areas.

- USDA Guaranteed Loan Program

- USDA Refinance transactions including Streamline Refinance, Streamline Assist Refinance and Rate & Term Refinance

- USDA Manual Underwriting

Specialty Programs

We are constantly adding loan programs to our portfolio to ensure that borrowers of all types can find something that suits their needs.

- Jumbo Loans

- Down Payment Assistance (DPA) programs

- Manufactured Home Financing

- Non-QM / Alternative Lending Programs

- Construction Financing

- TBD Property -

Full Credit / Income Underwrite - Reverse Mortgage

- HELOCs

- Temporary Interest Rate Buydowns

Human Resources

Human Resources is here to ensure you and your team have a seamless transition into our organization. From benefits packages to creative problem-solving to name plaques and more, we are here for you to help you find the “yes.”

Let us be your connection to our family-first financial organization!

Meri Kligman

Director of Human Resources

Office: (734) 335-4263

mkligman@smprate.com

Reema Kazzaz

Human Resources Manager

Office: (734) 519-5837

rkazzaz@smprate.com

Next-Level Marketing

We grow our business when you grow yours–take advantage of the incredible tools and features SMP provide.

Let working with us work for you

When you partner with Success Mortgage Partners, Inc., you partner with a mortgage industry leader. Our data-driven marketing approach will help you expand your network and boost your business.

Our team is dedicated to providing data-driven marketing solutions and quality content to help you outshine your competitors.

With this digital application, your clients can work on applications at their own pace, and you can even co-pilot the process!

Clients often begin as Prospects in Total Expert and continue to receive updated automated and manually sent emails and texts through TE. Total Expert will become your daily resource for all things marketing and customer communication.

Integrates data, marketing, sales, and compliance to support the entire customer lifecycle.

Monitors trends and customer analytics to ensure delivery of the right message at the right time.

Retains customers for life.

This system holds all customer and loan data, automatically syncing it with our other platforms.

Make communication easy for your prospects, customers, and co-marketing partners by using a medium many prefer–SMS message!

Record brief video messages to gain higher open and click-through rates!

A comprehensive co-marketing program providing your partners with customizable templates and lead management tools to streamline your network—all in one powerful platform!

Meet Mr. SMP—your one-stop resource for marketing needs and technical assistance. For quick follow-up and a swift solution, e-mail Mr. SMP to create an instant, trackable ticket. Problem solved!

Meet Mr. SMP—your one-stop resource for marketing needs and technical assistance. For quick follow-up and a swift solution, e-mail Mr. SMP to create an instant, trackable ticket. Problem solved!

Eric Skates

Director of Marketing

Office: (734) 881-9627

eskates@smprate.com

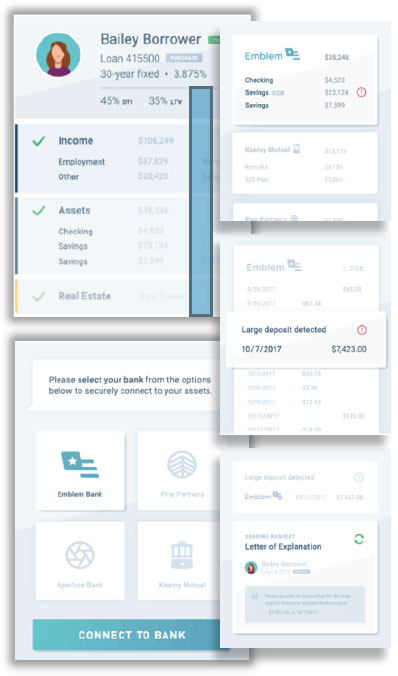

An innovative tool that monitors your past clients for mortgage or credit changes.

Alerts trigger communication immediately—so you’re the first to know and the first to react.

Mortgage Inquiry Watch

Win back your clients that are shopping for rates or reaching out to a new lender.

Credit Watch

Congratulate your former credit impaired clients the moment their FICO score goes above the minimum.

Equity Watch

Let your clients know when they have enough equity built up to pursue a cash-out refinance.

Listing Watch

Step in and offer your services when a property you closed on hits the market again.

CUSTOM MORTGAGE PRESENTATION

Engage your clients with the leading software for borrower conversion.

Total Cost Analysis (TCA) breaks down potential mortgage into simplified terms.

Allows you to remotely walk clients through a potential mortgage to show them how changes will impact upfront costs and their mortgage—today and for decades to come.

Clears up many client misconceptions about mortgages

Information Technology (I.T.)

TODAY'S SOLUTIONS–TOMORROW's innovations

- Software Development

- Encompass Team

- Blend Team

- Business Intelligence Team

"In today’s market, it is important to communicate at a high level, simplify how partners and customers do business with you, and have real-time data available to help you make more."

Steve Seese

Director of Technology

Office: (734) 927-6566

sseese@smprate.com

Title Partners offers numerous residential title insurance and escrow services to companies and individuals seeking to reduce complication and to get the job done right.

TITLE PARTNERS PROUDLY OFFERS TITLE SERVICES IN THE STATE OF MICHIGAN

As your partner in title, we provide all aspects of the title insurance industry—including residential and commercial refinance and purchase transactions. In addition, we make available contract closings, extended office hours, and flexible closing locations. We work with three large underwriters, giving us the ability to offer solutions to challenging files. Our mission is to provide first-rate service on every transaction, thereby enhancing, creating, and building long-term relationships with all of our past, present, and future clients.

- Refinance

- FSBO (For Sale by Owner)

- REO/Bank Owned

- Purchase

- Cash Sale, Land Contract, New Construction

Jaime Grassi-Graham

Agency Manager

Title Partners, LLC.

Office: (734) 927-1872

jgraham@mytitlepartners.com

Partners Making A Difference

To Restore Faith In Humanity–One Heart At A Time

Founded by our employees and owners, Partners Making a Difference (PMAD) is a non-profit organization dedicated to making a positive impact in the communities we serve. The largest contribution to PMAD comes from voluntary payroll deductions, which are tax-deductible at the end of the year. Beyond raising funds and making monetary donations, we also engage in community outreach and volunteer work.

As a top sponsor of the MBA Opens Doors Foundation, we provide holiday gifts and food to thousands of families in need each year. For multiple years, we have been recognized as one of the top sponsors in the state of Michigan for Volunteers of America — raising over $75,000 in just one year to assist those in need. Recently, we have extended support to Camp Sweeney and Camp Cole, which provide summer camps for children and teenagers with significant health problems.

WE SUPPORT

- MBA Opens Doors

- The Campfire Kids

- The Camp Cole Foundation

- Camp Sweeney

- Wreaths Across America

- Lakes Area Community Coalition

- Adopt a Family Program

- Fleece & Thank You

- ALSAC/St. Jude

- Kalamazoo Mortgage Hero Salute

- Ronald McDonald House Charities

- Schools across SMP’s service areas

If you would like to learn more, please visit our Facebook page where you can view photos, learn about upcoming events, and discover what makes us true partners—not only of our clients—but of our communities as well.

Ladies In Lending

Inspire. Collaborate. Encourage.

Ladies in Lending is a safe space designed to be a resource for success and a catalyst for change industry-wide. This virtual community was built to empower and encourage, offer advice and support, and develop new relationships with other Ladies in Lending. Get to know your network at exclusive workshops and events!

Check out the Ladies in Lending Podcast!

Ladies in Lending is the go-to podcast for women in the mortgage industry looking for real talk and relevant insights. Hosted by a powerhouse group of seasoned professionals, this show dives into everything from the latest lending trends and market shifts to tackling the unique challenges facing mortgage pros today. With a laid-back vibe and plenty of humor, each episode is packed with practical strategies, insider tips, and relatable stories to help listeners thrive in this dynamic space. Whether you're a loan officer or industry veteran, this podcast offers the perfect blend of knowledge, camaraderie, and entertainment to keep you informed and inspired.

Celebrating Success

While we continue to grow, we are dedicated to maintaining a close community that supports and inspires us.

Employee Outings

Annual Sales Conference

Annual Awards Gala

Annual Holiday Gala

Branch Managers Conference

SMP & Title Partners Family Picnic

Ladies in Lending Luncheon

Exclusive Trips for Top Producers

…and more!

Committees & Organizations

Partners Making a Difference (PMAD)

Ladies in Lending

Fun Committee

Culture Committee