Boost Conversions & Profits

Why we use Mortgage Coach

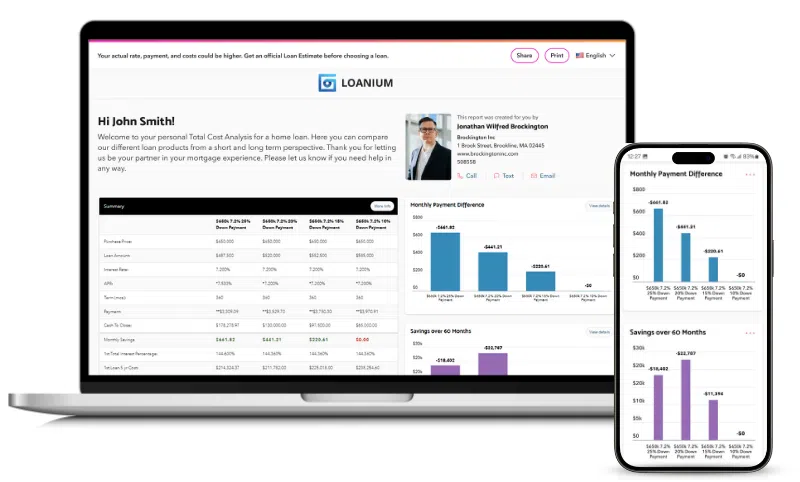

Success Mortgage Partners (SMP) uses Mortgage Coach to enhance the mortgage process by providing borrowers with personalized and comprehensive financial advice. The platform lets loan officers present multiple loan scenarios with clear visuals, helping borrowers understand their options and make informed decisions. This approach fosters transparency and trust, providing detailed financial analyses for each scenario and ensuring borrowers feel confident in their choices.

Mortgage Coach also increases efficiency by generating automated, professional reports and streamlining communication between loan officers and borrowers. This not only saves time but also reduces errors. SMP can differentiate itself from competitors by offering a higher level of personalized service, leading to higher borrower satisfaction and conversion rates. Additionally, Mortgage Coach empowers loan officers with the tools and training needed to stay informed and provide exceptional service, supporting SMP’s commitment to excellence in the mortgage industry.

What is Mortgage Coach?

Mortgage Coach is a digital platform that enhances the mortgage experience by providing personalized, detailed, and transparent financial insights. It offers loan officers tools to create customized loan scenarios, clear visual presentations, and automated reports, making it easier to communicate complex terms and build trust with borrowers. The platform also supports continuous learning and improved sales strategies.

Mortgage Coach delivers clear, visual explanations of loan options for borrowers, helping them understand each choice’s financial implications. This transparency fosters trust and confidence, leading to better-informed decisions and a more engaging mortgage experience. Mortgage Coach bridges the gap between loan officers and borrowers, resulting in higher conversion rates, increased borrower satisfaction, and a competitive edge in the mortgage industry.

Mortgage Coach is a powerful tool for delivering personalized, transparent, and visually engaging mortgage advice that enhances borrower understanding and satisfaction.